For operators in today’s fast-moving attractions, live events, ski resorts and cultural venues, payments aren’t just a back-office detail; they’re a critical part of the guest experience. How guests pay influences whether they complete a purchase, how much they spend, and whether they return. Even small moments of payment friction, like slow load times, declined cards, limited payment options, or extra steps at checkout, can cause guests to abandon their purchase entirely, making friction one of the leading contributors to revenue loss.

Behind every “tap to pay” moment is a complex ecosystem. Transactions must be fast, secure and consistent and across multiple channels, from mobile devices and online bookings to kiosks, counters, and roaming staff devices. Without the right expertise guiding that ecosystem, operators face higher risk, lost revenue and unhappy guests.

Four Reasons Expertise Matters

- Global acceptance, local confidence

Guests increasingly expect to pay with the method most convenient to them, whether that’s Apple Pay, PayPal, or a card issued overseas. Payment providers with a global reach can support diverse payment types, currencies, and settlement processes. - Security at scale

Fraud prevention is a constant battle. Providers with deep global data networks and proven security protocols can dramatically cut fraudulent transactions and false declines, protecting both guest trust and operator revenue. - Unified commerce, flexible experiences

Modern payment systems must go beyond isolated online or onsite solutions. Unified platforms allow operators to connect transactions across every channel, gaining a clearer view of guest behavior while offering smoother, more flexible experiences. - Smarter payments, stronger revenue

Payments are also a growth lever. With tools like digital wallets, tokenization, and intelligent fraud screening, operators can approve more legitimate transactions and offer relevant upsells at checkout. Payments become a source of value, not just another step in the process.

What the Data Shows

When payments are handled by providers with global reach and advanced AI-powered technology, the results speak for themselves. Tokens, especially network tokens, are a powerful tool that helps operators reduce payment friction and cut fraud to meet the needs of today’s guests:

- Up to 5% increase in authorization rates1 with network tokens.

- Up to 28% reduction in fraud2 for card-not-present (CNP) transactions through network tokenization.

- Up to 50% reduction in fraud3 when tokens replace traditional card credential entry.

- 80%+ of merchants saw an increase4 in the use of real-time payment over the past year.

- 59% of total global ecommerce sales5 are credited to mobile devices.

These results highlight a powerful opportunity: payment expertise can directly impact guest satisfaction and drive stronger business results.

Future Proof Your Payments

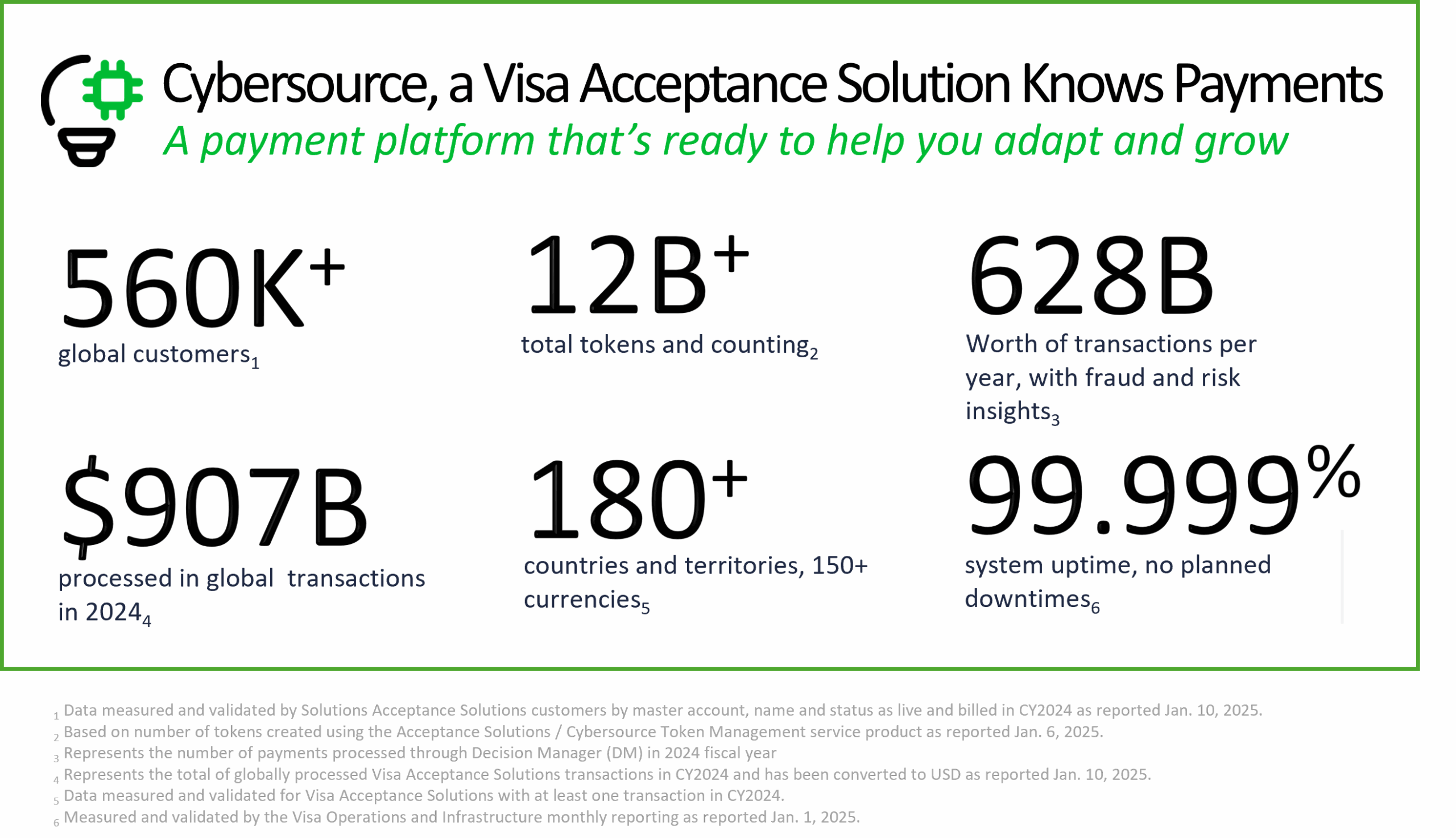

At accesso, our clients rely on us to deliver great guest experiences and the infrastructure that powers every transaction. That’s why we’ve partnered with Cybersource, a Visa Acceptance solution, an industry leader with decades of global payment expertise. Together, we’ve built a modern checkout solution that helps:

- Support demand with global and digital-first payment methods.

- Reduce fraud rates and increase authorization rates with network tokens.

- Improve conversions with faster checkout times.

Make Payments Your Strategic Advantage

Well-managed payments are no longer just an operational necessity; they’re a powerful lever for growth. When transactions are protected, optimized, and intelligently routed, operators see higher approval rates and lower fraud. Partnering with providers that bring true global, unified payment expertise is the difference between accelerating revenue and being held back by risk and complexity.

By working with trusted leaders like Cybersource, a Visa Acceptance Solution, accesso helps operators unlock payments that are not only secure but fluid and built to capture more revenue with every transaction in every channel.

Sources: